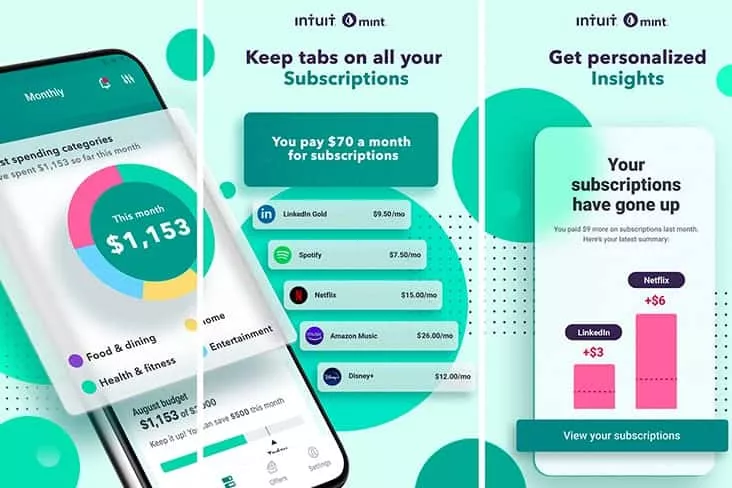

New App Helps People Track Their Spending and Save Money

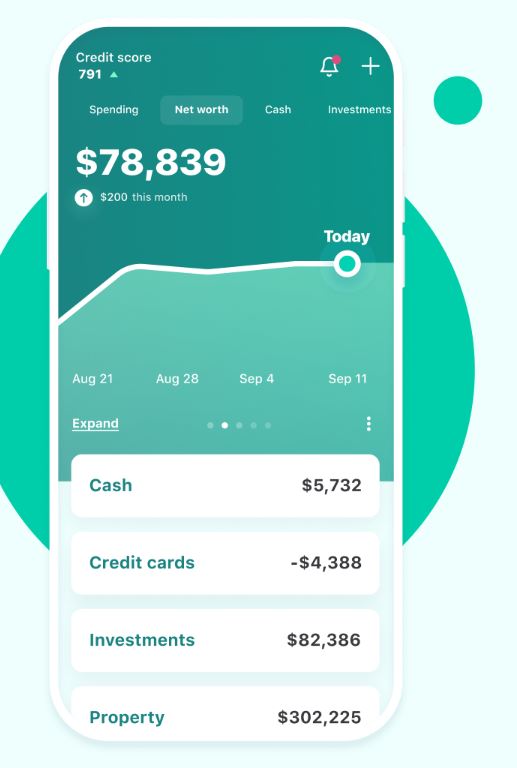

A new app called “Mint” is helping people track their spending and save money. The app allows users to connect their bank accounts and credit cards, and it automatically tracks their spending. Mint also offers tips on how to save money, such as setting budgets and finding coupons.

Mint is a free app that is available for iOS and Android devices. It has been downloaded over 10 million times, and it has a rating of 4.7 out of 5 stars on the App Store.

Mint is indeed a popular and user-friendly app that can be a valuable tool for managing your finances. Here are some more details and tips on how to effectively use Mint to track your spending and save money:

- Connect All Your Financial Accounts: To get a comprehensive view of your financial situation, connect all your bank accounts, credit cards, loans, and investment accounts to Mint. This way, you’ll have a real-time snapshot of your financial health.

- Set Realistic Budgets: Mint allows you to create budgets for various categories of spending like groceries, dining out, entertainment, and more. Set achievable monthly or yearly budget limits for each category based on your financial goals.

- Track Your Spending: Keep an eye on your spending trends. Mint categorizes your transactions automatically, but you can also customize categories to fit your needs. Regularly review your spending to see where your money is going.

- Receive Alerts: Mint can send you alerts when you’re approaching or exceeding your budget limits. These notifications can help you stay on track and make necessary adjustments.

- Use Goals: Mint offers a feature called “Goals” that allows you to set specific financial objectives, such as saving for a vacation or paying off a credit card. The app can help you track your progress toward these goals.

- Find Discounts and Coupons: Take advantage of Mint’s ability to find coupons and discounts for your favorite stores and brands. This can help you save money on everyday purchases.

- Monitor Your Credit Score: Mint provides access to your credit score and credit report. Regularly check your credit health and work on improving your credit score over time.

- Stay Informed: Mint offers insights and recommendations based on your financial behavior. Pay attention to these suggestions to discover new ways to save money and manage your finances more efficiently.

- Set Up Reminders: You can set up bill reminders in Mint to ensure you never miss a payment deadline. Late fees and interest charges can be costly, so staying organized with your bills is crucial.

- Review and Adjust: Periodically review your financial goals, budgets, and spending habits. Life circumstances change, and your financial plan should evolve with them. Adjust your goals and budgets as needed.

- Secure Your Data: Since Mint deals with sensitive financial information, make sure to use strong passwords, enable two-factor authentication, and keep your Mint account secure to protect your financial data.

Mint is a helpful tool for anyone who wants to track their spending and save money. It is easy to use and it offers a variety of features that can help users reach their financial goals.

If you are looking for an app to help you track your spending and save money, Mint is a great option. It is free to use and it has a lot of features that can help you get started on your financial journey.

Here are some additional tips for using Mint to track your spending and save money:

- Connect all of your bank accounts and credit cards to Mint. This will give you a complete picture of your spending.

- Set budgets for different categories of spending, such as groceries, transportation, and entertainment.

- Review your spending on a regular basis and make adjustments to your budget as needed.

- Use Mint’s tips on how to save money. These tips can help you find ways to cut back on your spending and save more money.

By using Mint and following these tips, you can track your spending, set budgets, and save money. These are all important steps towards financial health.